puerto rico tax incentives 2020

Get in touch to know more about act 20 Puerto Rico. With an executive team made up of thought leaders who have made significant contributions.

Act 22 60 Donation And Charity Information Karma Honey Project

An education base began in the early to mid-1950s when the Interamerican University opened a.

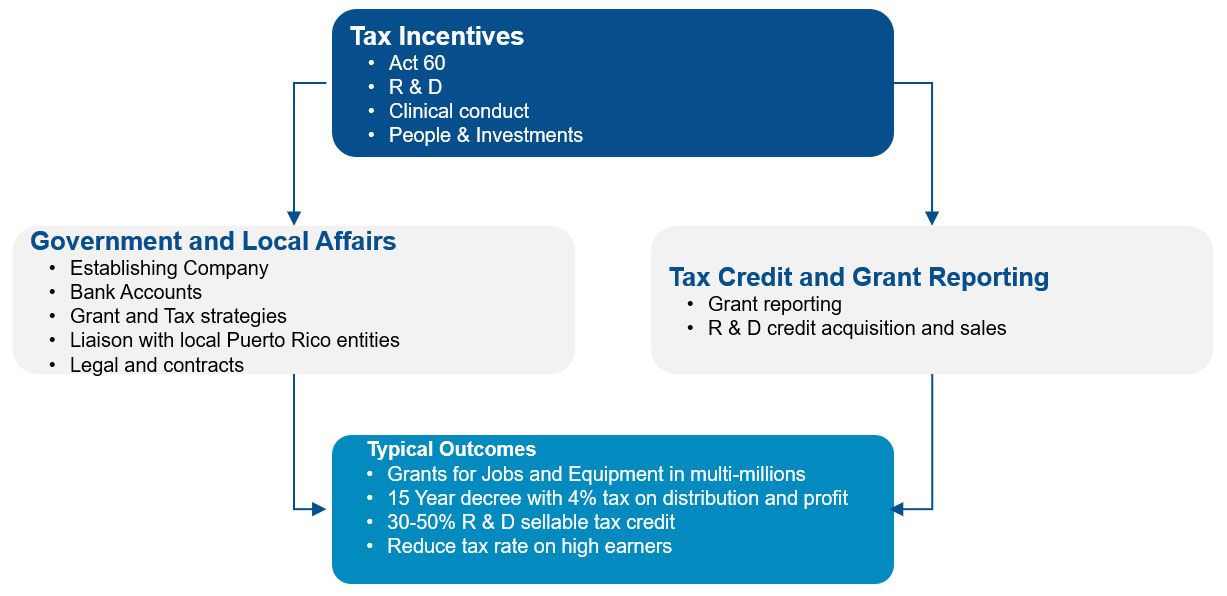

. The economy of Puerto Rico is classified as a high income economy by the World Bank and as the most competitive economy in Latin America by the World Economic Forum. Semiconductor manufacturing research and development and supply chain security. Though the Act 60 tax incentives have existed in Puerto Rico since 2012 then known as Act 2022 the rise of cryptocurrency as well as the ongoing debt crisis has made the island attractive to wealthy foreign investors eager to reap the benefits of these tax exemptions and turn Puerto Rico into a crypto hub.

Introduced in House 06112020 Creating Helpful Incentives to Produce Semiconductors for America Act or the CHIPS for America Act. Current temperature in Puerto Rico 85 F. Synergi is operated by tax credit industry veterans with more than 40 years of experience.

2 Paseo La Princesa San Juan PR 00902. In 1899 the United States conducted its first census of Puerto Rico finding that the population of Cayey was 14442. Puerto Rico was ceded by Spain in the aftermath of the SpanishAmerican War under the terms of the Treaty of Paris of 1898 and became a territory of the United States.

Solar energy wind energy hydropower and biomass. The Puerto Rico Tourism Company PRTC founded in 1970 is a public corporation responsible for stimulating promoting and regulating the development of Puerto Ricos tourism industry. The main drivers of Puerto Ricos economy are manufacturing primarily pharmaceuticals textiles petrochemicals and electronics.

Act 20 and 22 tax incentives have been replaced by Act 60 as of January 1 2020. This bill establishes investments and incentives to support US. Act 60 provides millions of dollars in tax exemptions to.

Specifically the bill provides an income tax credit for semiconductor. 92 For fiscal year 2021 July 2020June 2021 about 3 of PREPAs electricity came from renewable energy. Under the Puerto Rico Energy Public Policy Act PREPA must obtain 40 of its electricity from renewable resources by 2025 60 by 2040 and 100 by 2050.

Followed by the service industry notably finance insurance real estate and. Synergi specializes in federal and state tax credit programs as well as disaster relief incentives for employers across the United States including Puerto Rico. Puerto Ricos renewable resources include.

Tax Weary Americans Find Haven In Puerto Rico Frost Law Washington Dc

Pin On It Works Puerto Rico Wraps

Act 22 60 Donation And Charity Information Karma Honey Project

Puerto Rico Relocation Checklist What To Do Before Your Move Relocate To Puerto Rico With Act 60 20 22

Puerto Rico Tax Incentives Pellot Gonzalez

Act 22 60 Donation And Charity Information Karma Honey Project

Pr Relocation Guidebook Short Relocate To Puerto Rico With Act 60 20 22

Puerto Rico Relocation Checklist What To Do Before Your Move Relocate To Puerto Rico With Act 60 20 22

Understanding The General Elections In Puerto Rico Relocate To Puerto Rico With Act 60 20 22

Puerto Rico Extends Due Dates For Retirement Plan Tax Reporting And Withholding Obligations Due To Covid 19 Ogletree Deakins

Shocking Reasons You Should Never Move To Puerto Rico Youtube

An Urgent Rescue Plan For Puerto Rico Center For American Progress

Puerto Rico Creates Tax Shelters In Appeal To The Rich The New York Times

What U S Business Leaders Can Learn From Puerto Rico S Booming Real Estate Market

Blog Relocate And Move To Puerto Rico With Act 20 Act 22

The Time Has Come To See Puerto Rico Differently As Massive 100b Capital Market Looms Marketnews Puertorico Tax Incentiv Puerto Rico Puerto Paris Skyline

Puerto Rico Incentives Code Act No 60 Now Officially In Effect